Goal

Search for Loans

Learn about the different types of loans and how to determine if they're right for you.

If you haven’t already filed for the FAFSA, you will first want to do that, as federal loans are offered based on the information inputted in your FAFSA. It is possible that after any grant, scholarship, and work-study money you receive, you may still have a remaining portion of your tuition and other costs that will need to be covered. It is common for students and parents to then consider loans. In fact, most financial aid (54%) comes in the form of loans to students or parents - aid that must be repaid. However, federal student loans do not transfer directly between colleges. There is a chance that once your FAFSA is renewed, you may lose certain loans that you were previously granted.

Most loans that are awarded based on financial need are low-interest loans sponsored by the federal government. These loans are subsidized by the government so no interest accrues until you begin repaying after you graduate. There are other loan options available that are not need-based. If you need to borrow money to attend college, be sure your federal loan options are exhausted before considering private loans. And don’t borrow more than you need or can afford to pay back! If you receive private loans, you may need to fill out deferment forms or school certifications to continue receiving those funds.

“When you leave a college, your outstanding student loans enter a ‘grace period.’ Occasionally you might be required to start paying those loans back quite soon - sometimes within sixth months. Fortunately, if you immediately transfer to a new college, you are eligible to apply for an in-school loan deferment. This allows you to delay all loan repayments until you leave school.” BestColleges.com

If you're receiving federal student loans at your current school, you'll go through exit counseling. Find out what you need to know about how your federal student loans are affected when you transfer schools.

Types of Loans

Federal Student Loans

In order to qualify for any of the following loans categorized under “Federal Student Loans”, you must fill out the FAFSA.

Financial need-based loans

Subsidized Stafford or Direct Loans

Awarded by the U.S. Department of Education (ED) and is owed to the ED.

They have interest rates in the 4-6% range but varies depending on the market.

Up to $5,500 can be lent for the first year and can go up for each year of school you complete. Your school will determine the amount you can borrow, and can not exceed your financial need.

The federal government pays the yearly interest while you’re in school and you don’t have to make any payments until 6 months after you graduate.

Non-Financial Need-Based Loans

Unsubsidized Stafford or Direct Loans

Not required to demonstrate a financial need and can be used to help pay the family share of costs.

You’re responsible for paying interest on the loan in school.

You may choose to capitalize the interest, in that the interest will be added to the principal amount of your loan. The advantage of doing this is that no interest payments are required. The disadvantage is that the interest is added to the loan, meaning that you will repay more money to the lender.

Direct PLUS Loans

This type of loan is made to the parents of the student to help pay expenses not covered by other financial aid.

It is the largest source of parent loans.

Parents can borrow up to the full cost of attendance minus any aid received, and repayment starts 60 days after money is paid to college.

The maximum PLUS loan amount you can borrow is the cost of attendance (determined by the school) minus any other financial assistance received.

In 2017-2018 the interest rate was fixed at 7%.

There is a loan fee in addition to the interest needed to be paid.

For more information visit:

State/College Loans

College-sponsored loans (for students)

Some colleges have their own loan funds for students. Interest rates may be lower than federal student loans. Because not all schools offer this option, you’ll want to check by accessing the financial aid information for your college.

State-sponsored loans

State student loan programs are some of the most accessible, affordable and reliable financial aid tools, and vary state by state.

To access state loans in your college’s state, visit: https://www2.ed.gov/about/contacts/state/index.html

College-sponsors loans (for parents)

A small number of colleges offer their own parent loans, usually at a better rate than PLUS. Check each college’s financial aid materials to see if such loans are available. To learn about college loans that may be available from your state, use the contact information on the U.S. Department of Education's list of state higher-education agencies.

Private Loans

Private Loans should be sought out only if your grants, scholarships, federal loans, college, and state loans don’t provide enough money to cover expenses. If you receive private loans and plan to transfer, you may need to fill out deferment forms or school certifications to continue receiving those funds.

Private Student Loans

A number of lender like banks, credit unions and other financial institutions offer private education loans to students. These loans are not subsidized and usually carry a higher interest rate than the federal need-based loans.

Often require a cosigner — someone who promises to repay the money if you fail to do so.

Private Parent Loans

A number of lenders like banks, credit unions and other financial institutions offer private education loans for parents. These loans usually carry a higher interest rate than PLUS Loans.

Important Loan Terms

APR (Annual Percentage Rate): the total cost of a loan, including the interest rate and fees, expressed as the percentage of the amount borrowed that you have to pay each year. It is a good way to compare loans from different lenders.

Co-borrower or co-signer: a person who agree to pay the loan if the primary borrower can not or does not pay. Some lenders require students to get a co-borrower with good credit before they will make a loan.

Cost of Attendance: the total cost of attending a particular college for a year, including tuition and fees, housing costs, food, and books and supplies, transportation, and other necessary expenses such as a personal computer and health care.

Credit: indicates a person’s financial strength, which includes a history of having paid bills and the demonstrated ability to repay a future loan.

Discount: a reduction in the interest rate or the fees charged on a loan.

Interest: the money or price paid by the borrower to use someone else’s funds. Interest is stated as a percentage of the original amount borrowed.

Promissory Note or Credit Agreement: a legal contract the borrower signs with the lender that details the terms of the loan including how and when it must be repaid.

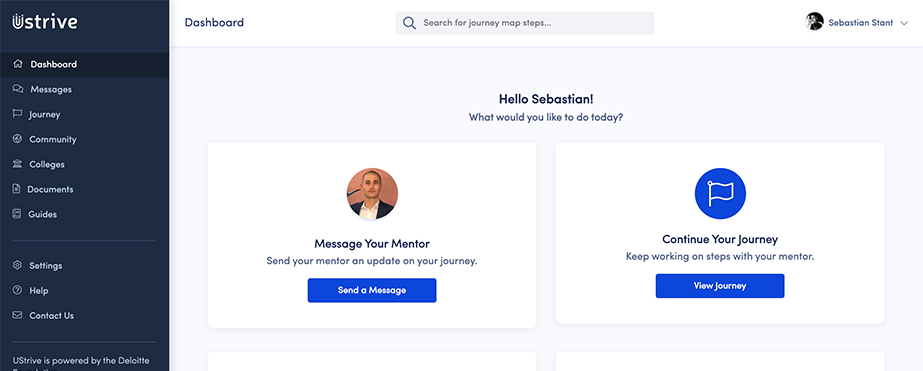

Want to learn more?

A mentor can help with this topic & many more. Join thousands of students & pick a mentor today!

It's 100% free, forever.

© UStrive 2022, All Rights Reserved