Goal

Complete the FAFSA

Complete and submit the FAFSA.

The 2025-26 FAFSA form opened in December 2024 and should be completed your senior year of high school and every year after that in which you need financial aid for college.

Overview

The FAFSA, or Free Application for Federal Student Aid, is the only way to apply for federal student aid (aid that comes from the United States government), like Pell Grants, Federal Loans, and work-study programs.

Individual states and colleges often use the information on your FAFSA to determine whether or not you are eligible for state aid and institutional aid and some colleges even make completing the FAFSA a requirement for students looking to apply to the school, regardless of whether they will end up receiving financial aid or not.

The FAFSA will ask for information from you about your family’s financial history and current status to determine how much they can afford to contribute to your college education.In turn, this lets federal, state, and institutional financial bodies determine how much financial aid to give to you.

type: embedded-entry-inline id: 6LUli9cksMPuQ31PRWhiPB

Why fill out the FAFSA?

It's the single most important thing you can do to help yourself pay for college.

If you don’t fill out the FAFSA you will not be eligible for federal aid, and might not be eligible for any state or institutional aid either.

Some colleges require that students submit the FAFSA form (regardless of whether they will receive any financial aid or not) as part of the admissions process.

How to know if you’re eligible for the FAFSA

Most U.S. citizens (and select non-citizens*) are eligible to fill out the FAFSA.

Check out www.studentaid.ed.gov eligibility for detailed requirements. If you may not qualify for FAFSA, there are still other ways to fund going to college. See “Undocumented Students ('Dreamers').”

How to Fill out the FAFSA

The FAFSA is available online at www.studentaid.ed.gov.

Before You Apply

Here's a helpful graphic: https://studentaid.gov/sites/default/files/fafsa-process.png

Prepare & collect all of the information you need for the FAFSA - Click here for a checklist on the information you’ll need to collect ahead of time. (Try This Resource: 2023–24 FAFSA on the Web Worksheet— Provides a preview of the questions students and parents may be asked while completing the FAFSA form.)

Create an FSA ID - Set up your user ID and password before you start your FAFSA application. These will become your online identifiers for all federal student aid programs. You will need to provide your own email address and password. (Parents will create their own account using a different email address and password).

Complete your income tax return - When completing your FAFSA, you and your family will be able to use your most recent completed tax returns. (For example, when completing your FAFSA during the 2024-2025 school year, you can use your 2022 tax returns.) You can transfer your income data directly from the IRS website to your FAFSA, making it easier to accurately complete the FAFSA.

Estimate your aid - Federal Student Aid Estimator Tool gives you a free early estimate of your eligibility for federal student aid. This information helps families plan ahead for college. Note: this is only a planning tool, and not an application for aid.

When to fill out the FAFSA

December 1st of your senior year is the first day you can file for the FAFSA.

Be sure to complete your FAFSA soon after it becomes available on in December. Doing so can help you get a jump on other financial aid applications (state or institutional aid) that may have early deadlines. There are also few federal student aid programs that have limited funds, so the earlier you apply, the more likely you are to qualify for more funding. Lastly, it will give you more information earlier about the financial aid you qualify for and will help you make an informed decision about which college is the best financial fit for you.

The New IRS Data Retrieval Tool You can save time and effort if you qualify to use the IRS Data Retrieval Tool. It will transfer your income tax data directly from the IRS to your online FAFSA. Visit the FAFSA website for eligibility requirements.

You will fill out a new FAFSA for each year you plan to be a student. This means that if your family income changes from year to year, the amount of money that you can and will receive may change as well.

How to know which kind of aid you’re eligible for

Your Estimated Family Contribution (EFC) will determine the amount of aid you qualify for. EFC is what amount of money your parents or guardians are expected to contribute towards your education. This figure is determined based on the information you include in your FAFSA application.

The FAFSA will make you eligible for grants (which do not have to be paid back) and loans (which do)

This link describes each of the federal grants available.

This link describes each of the types of federal loans available.

type: embedded-entry-inline id: 6cLVD5ch5MEerLIWdjr0bG

How many schools can you list on your FAFSA?

Your Free Application for Federal Student Aid (FAFSA) can list up to ten colleges. Once you receive your Student Aid Report (SAR), you can make the information available to more than ten colleges through one of the following options. Each option will allow the college to receive an electronic copy of your SAR, and you will also receive an updated SAR.

Click Login on the home page and log in to FAFSA on the Web. You will be given the option to Make FAFSA Corrections. Remove some of the colleges listed on your FAFSA, add the additional school codes, and submit the corrections for processing.

Give the additional colleges your Social Security Number, name, and the Data Release Number (DRN) from your SAR so that they can add their school code to your FAFSA and receive an electronic copy of your SAR.

Call the Federal Student Aid Information Center and have them add the colleges for you. When you call, you must provide the DRN from your SAR or confirmation page. Refer to the Help page for contact information.

If you have a paper SAR, you can replace the colleges listed on the SAR with other colleges, and mail the SAR back to Federal Student Aid. Note that the paper SAR only allows you to change up to four colleges.

Note: If there are ten colleges on your FAFSA, any new school codes that you add will replace one or more of the school codes already listed.

You should add any school that you plan on applying to, or that you have applied to, even if you haven’t been accepted yet. In most cases, once a school accepts you, they will then work on developing your aid offer.

Important FAFSA Deadlines

December 2024: FAFSA Application opens up.

State Deadlines: Each state has a different deadline for state financial aid programs Check your state’s deadline by clicking here.

College Deadlines: Many colleges have their own FAFSA deadline. You’ll need to submit your FAFSA form by that due date in order to receive as much financial aid as possible from that college. These deadlines are usually earlier in the year (often in February or March, although some are even earlier). Check with each college you are interested in attending about their FAFSA deadline, and about whether that deadline refers to the date the college receives your FAFSA, or the date your FAFSA is processed.

Other Financial Aid: Some programs other than government or school aid require that you fill out and submit the FAFSA form. For instance, you can’t get certain private scholarships unless you’re eligible for a Federal Pell Grant—and you can’t find out whether you’re eligible for a Pell Grant unless you fill out and submit the FAFSA form. If the private scholarship application deadline is in early to mid-January, you’ll need to submit your FAFSA form before that deadline.

June 30: Online applications for federal aid must be submitted by midnight Central Time.

September 14: Any corrections or updates to your federal aid application must be submitted by midnight Central Time.

What happens after you complete the FAFSA application?

Next Steps: https://studentaid.ed.gov/sa/fafsa/next-steps

Have questions about the FAFSA? Get free help anytime with Aiden.

Want to learn more?

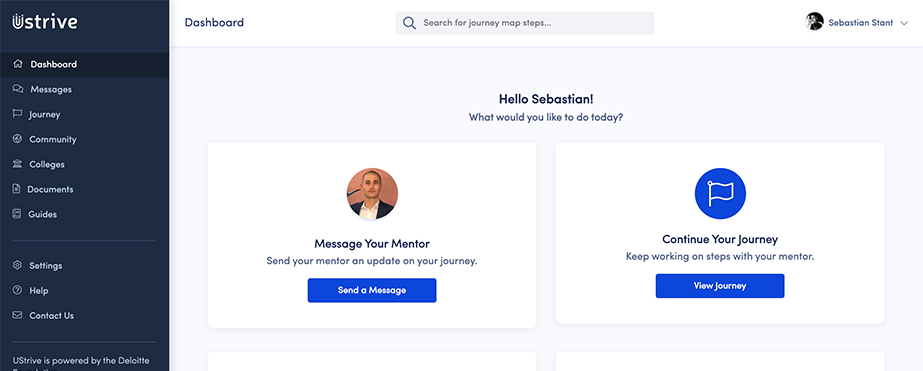

A mentor can help with this topic & many more. Join thousands of students & pick a mentor today!

It's 100% free, forever.

© UStrive 2022, All Rights Reserved